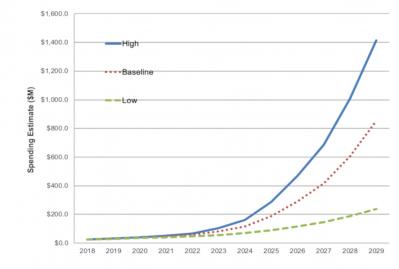

Objective Analysis and Coughlin Associates say that the emerging memory market will reach $20 billion in revenues by 2029, which will boost the emerging memory manufacturing equipment market to $854 million in revenues.

According to the "Emerging Memories Ramp Up" report, offered by Objective and Coughlin, the market will grow by displacing the currently used NOR flash and SRAM memories which are less efficient - and will also displace a share of the DRAM market. Emerging memories will be used both as standalone memory chips and as embedded memories within other chips (such as microcontrollers, ASICs, and even compute processors). Future process shrinks and improved economies of scale will drive down prices, which will allow emerging memories to compete more effectively against today's most popular volatile and nonvolatile technologies.

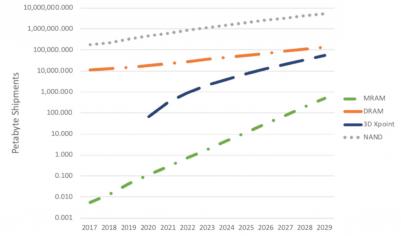

Looking specifically into MRAM and STT-MRAM technologies, the report says that revenues will grow 170X from 2018 to 2029, reaching almost $4 billion in revenues. In fact MRAM memories will enjoy the most stellar growth of all emerging memory technologies. Shipments in terms of capacity are expected to grow from around 0.1 Petabytes in 2019 to almost 1 million Petabytes by 2029.

This report examines PCM, ReRAM, FRAM and MRAM as well as a variety of less mainstream technologies, explaining each one's competitive strengths and weaknesses. At 171 pages the in-depth publication provides a full 1242 figures and 30 tables, with high, baseline, and low forecasts for embedded memory on SoCs, stand-alone emerging memory chips like MRAM and ReRAM, 3D XPoint Memory, and capital equipment spending forecasts for the new equipment that will be required to support this transition.